Reasons to create an Estate Plan in 2023:

Reasons to create an Estate Plan in 2023: Contact us today to schedule a telephone, video or in-office consultation to address your estate planning needs. This

We offer the option of consultations and meetings in-person, video & phone.

Reasons to create an Estate Plan in 2023: Contact us today to schedule a telephone, video or in-office consultation to address your estate planning needs. This

Many people are unaware that a holiday gift splurge may actually subject the donor to taxes. The Internal Revenue Code imposes up to a 40%

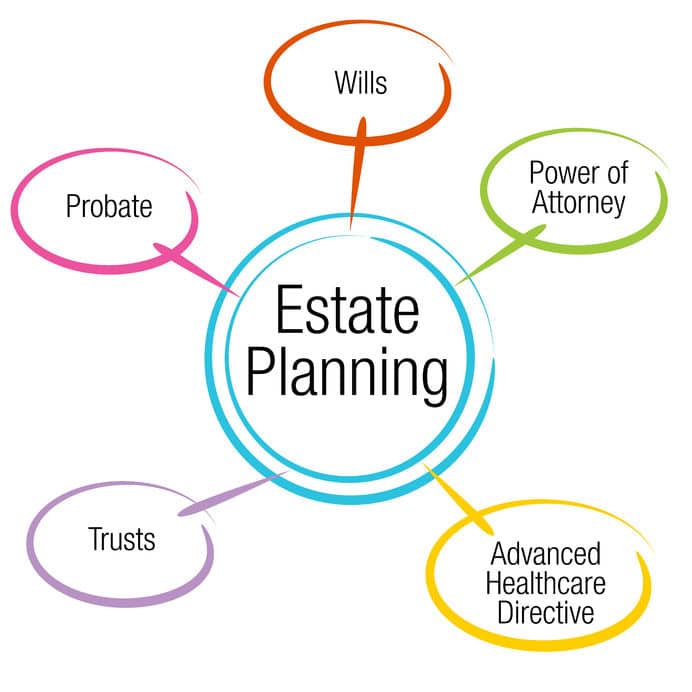

Estate planning affords us the peace of mind of knowing that our assets will be distributed as we choose, and also provides us comfort in

Assets transfer at death through various modes. When a decedent leaves a trust with assets appropriately titled to it, the trust is administered, and the

When used properly, LLCs are an effective way to insulate property owners from personal liability, especially in the case of rental properties. But did you

If you are like many of our clients, you may have executed your trust a couple of decades ago and left it to collect dust

If you and your spouse created a trust prior to 2010, it is quite possible that your trust no longer accomplishes what you intended it

A fiduciary is a person who is entrusted to take action on behalf of another person or entity and is legally obligated to act in

Every person has a credit against payment of estate and gift taxes of $12,060,000 in 2022. Spouses each have the credit and thus can together pass

Being named as an Executor in a decedent’s Last Will and Testament imposes significant responsibility on a person. The Executor, or other court appointed Personal